THE WEEK ON WALL STREET

Stocks tumbled last week as investors reconsidered their interest rate expectations after Fed Chair Powell’s Congressional testimony that rates may need to go higher. Stocks also were rattled when a west coast bank was placed into receivership on Friday following a run on deposits.

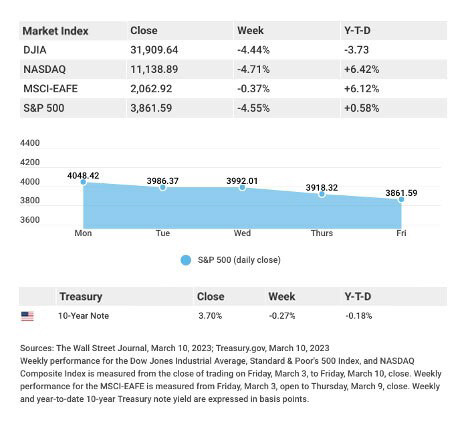

The Dow Jones Industrial Average dropped 4.44%, while the Standard & Poor’s 500 lost 4.55%. The Nasdaq Composite index fell 4.71% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, slipped 0.37%.1,2,3

RATE FEARS, BANK SCARE

Congressional testimony on Tuesday by Fed Chair Jerome Powell that interest rates may require a higher increase faster than planned unnerved investors. After stabilizing the following day, stocks trended lower as the financial sector came under pressure. The lower move was triggered by Silicon Valley Bank’s liquidity issues. Many other regional and money center banks could not escape the selling.

Labor market strength in a Friday report exacerbated rate-hike anxieties, though cooling wage gains balanced an above-consensus new jobs number. Markets appeared to take the employment report in stride but fell on worries arising from the shutdown of the tech-centric bank with possibly more bank rescues needed.4

POWELL’S CONGRESSIONAL TESTIMONY

Fed Chair Powell last week testified on Capitol Hill during which he acknowledged that the economy was running hotter than he had expected. He said that labor market strength and stubbornly elevated inflation may require the Fed to raise rates quicker than anticipated and above levels previously contemplated.

The market did not respond well to Powell’s change of tone. Powell did say that the FOMC would consider the monthly employment report released last Friday and upcoming inflation reports before arriving at a decision. With the new issue of bank stability due to the past 12 months of fast paced interest rate hikes, all future rate hikes will most likely be measured.

TIP OF THE WEEK

Entering the armed forces, going to a junior college and transferring to a university, attending a state college instead of a private one – these are all paths toward making higher education more affordable.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: Consumer Price Index (CPI).

Wednesday: Producer Price Index (PPI). Retail Sales.

Thursday: Jobless Claims. Housing Starts.

Friday: Industrial Production. Consumer Sentiment. Index of Leading Economic Indicators.

Source: Econoday, March 10, 2022

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Wednesday: Adobe, Inc. (ADBE), Lennar Corporation (LEN).

Thursday: FedEx Corporation (FDX), Dollar General Corporation (DG).

Source: Zacks, March 10, 2022

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

CITATIONS:

1. The Wall Street Journal, March 10, 2023

2. The Wall Street Journal, March 10, 2023

3. The Wall Street Journal, March 10, 2023

4. The Wall Street Journal, March 10, 2023

QUOTE OF THE WEEK

“He who is not courageous enough to take risks will accomplish nothing in life.”

MUHAMMAD ALI

THE WEEKY RIDDLE

You need to park a car for the weekend. You find a parking space marked “2-Hour Parking M-F, 8am-6pm” with no other restrictions. You call the city and find that overnight parking is allowed on this block. So, what is the maximum amount of time you can leave your car in this space without getting a ticket?

LAST WEEK’S RIDDLE:

We know that a seahorse isn’t a horse, and we know that a silverfish isn’t a fish. For that matter, a snakehead isn’t a snake- but what is it?

ANSWER: A Predatory fish found in both Asia and Africa.

Know someone who could use information like this?

Please feel free to send us their contact information via phone or email.

(Don’t worry – we’ll request their permission before adding them to our mailing list.)

Jerry Slusiewicz may be reached at 949-219-0692 or 800-449-9501

jerry@pfpinvest.com

pfpinvest.com

This Economic Update should not be construed as a solicitation or an offer to buy or sell any public or private securities. Securities offered through Pacific Financial Planners. Please check with a Financial Advisor regarding your specific needs before making any investment decisions.